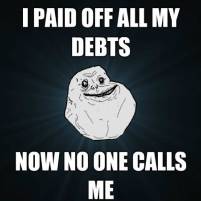

What do you love about owning your own business? You could, most likely, list 100 things that are fantastic about running your own company and your answers would be unique and fascinating. What could derail such positive reasons to be your own boss? We all know that one of the most exasperating experiences of doing business is when we have to deal with customers that don’t pay their bills. This is where a debt collection agency can make a world of difference to a business whose morale might be sagging after running up against clientele that will do everything in their power to avoid paying their debts. These debtors must be convinced that settling their accounts would be in their own self-interest. Here are a few of the many reasons to hire the services of a debt collector to get the job done after creditors have had no luck collecting unpaid invoices.

Five Reasons to Hire a Debt Collection Agency

Topics: Collection Strategy, old debt, debt collections, collection agency, student debt, unpaid debt, accounts receivable, outsourcing, revenue, debt settlement, debt collection regulations, medical collections, medical debt

Topics: old debt, debt collections, collection agency, get out of debt, how to get out of debt, student debt, unpaid debt, being debt free, outsourcing, debt settlement, debt collection regulations, medical collections, medical debt

From Over-Dunn to Well-Dunn:

A Win-Win Consumer-centric Approach Rooted in Compassionate Communication

Topics: Collection Strategy, Compliance, Technology, old debt, debt collections, collection agency, how to get out of debt, unpaid debt, accounts receivable, outsourcing, commission rate, revenue, recovery rate, debt settlement, Regulation F, debt collection regulations, medical collections, medical debt

When is the Right Time to Hire a Collection Agency

Even though not everyone may have a favorable view of debt collection agencies, the fact is, they perform a vital service that keeps costs down and maintains client relationships. Before you take inventory and decide whether hiring an agency is the right move for your business, consider all the ways in which using collections is the smarter and more efficient move for you and your business.

Topics: Collection Strategy, Compliance, Technology, old debt, debt collections, collection agency, how to get out of debt, unpaid debt, accounts receivable, outsourcing, commission rate, revenue, recovery rate, debt settlement, Regulation F, debt collection regulations, medical collections, medical debt

Have you ever asked yourself, just what exactly does a debt collection service do and how does it work? Well then, you’re in luck! We’ve outlined the most common topics about how agencies operate, why we need them, to the evolution and future of the debt collection industry.

Topics: Collection Strategy, Compliance, Technology, old debt, debt collections, collection agency, how to get out of debt, unpaid debt, accounts receivable, outsourcing, commission rate, revenue, recovery rate, debt settlement, Regulation F, debt collection regulations, medical collections, medical debt

What You Need to Know About Medical Debt and Collections

At some point in your life, you may have wondered what it means to have your medical bills referred to a collection agency. If this does happen, there are short-term and long-term consequences. Let’s unravel any mystery by explaining why this happens and what it means for your credit if it does, what to do if it happens, and how to recover your credit.

Topics: Credit, old debt, debt collections, collection agency, get out of debt, how to get out of debt, unpaid debt, being debt free, debt settlement, medical collections, medical debt